Keep More. Protect More. Exit Better.

If you’re overpaying tax, carrying hidden insurance gaps, or unsure what your business is worth, you can’t make confident moves. We give you a clear flight plan...start free today.

Start Free: Business Tax Savings Radar™

The Real Risk

The Stakes

Failures to Avoid:

Missed six-figure tax savings each year

Insurance gaps that can wreck a deal or block growth

Selling too early, too late, or for less than it’s worth

You’re not alone. Most owners juggle tax, risk, valuation, and exit with different pros who don’t coordinate.

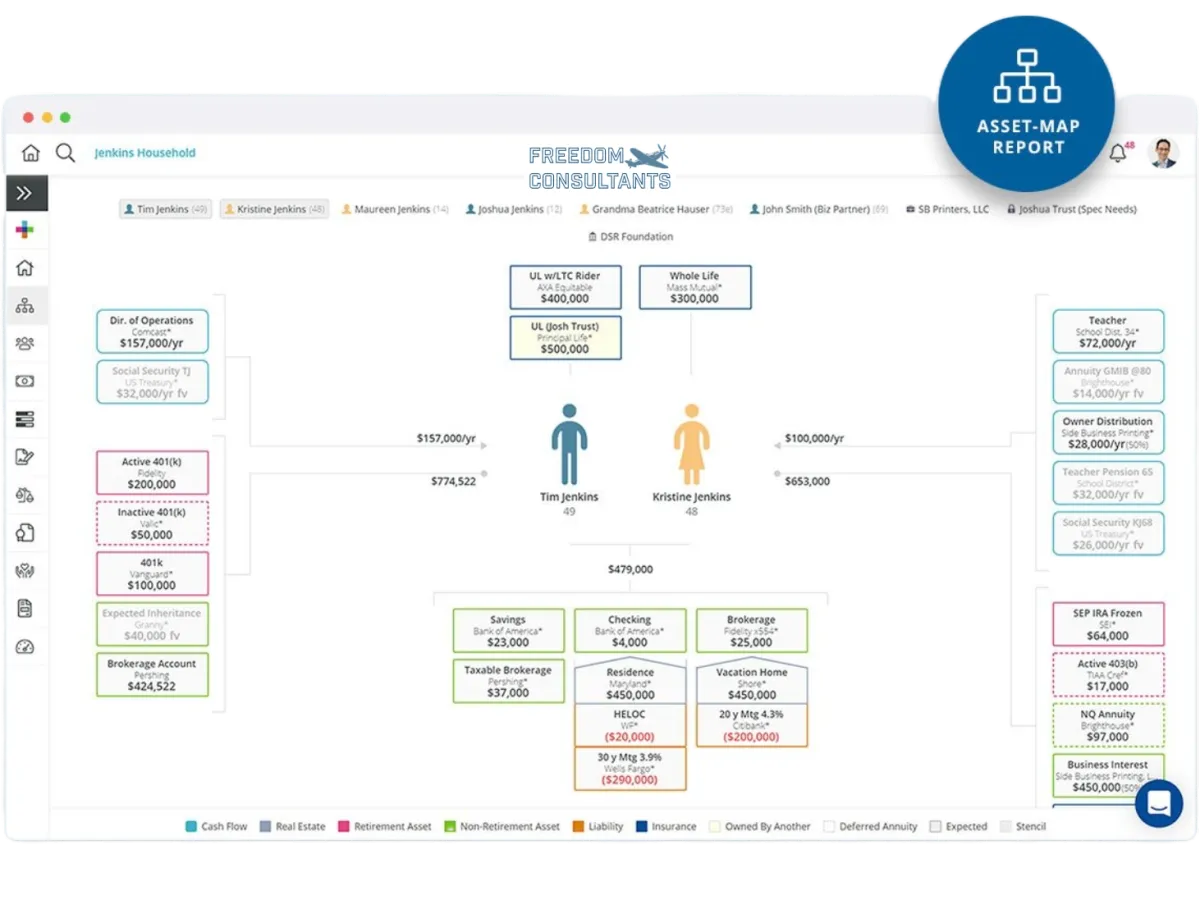

We coordinate it. Pilot Your Wealth™ and the Freedom Consultants community align your CPA, insurance, valuation, and exit team under one flight plan.

Start with the

The Plan

Most owners hope they’re protected.

Be one of the few brave enough to find out for sure.

Start Free

Business Tax Savings Radar™

Lock in Your Plan

Pre-Flight Tax Plan™

or

Pilot Orientation™

Execute

Wealth Map ATC™

&

Exit Flight Plan™

You’re the pilot. We’re your ATC, guiding you safely to wealth, protection, and legacy.

Meet Your Flight Crew

Ethan Day

Freedom Consultant

Tony Miller

Freedom Consultant

What Happens After the Business Tax Savings Radar™

Once you complete your Business Tax Savings Radar™, you’ll receive your score.

93%

of business owners are

overpaying their taxes

58%

privately-held business owners

lack any transition plans

100+

Speakers

8HR

Workshops

These aren’t just stats! They’re your wake-up call:

You might be leaving money on the table every tax season.

Your business could collapse, or never yield its full value, without a clear exit plan.

You’ve got a rare opportunity. The Business Tax Savings Radar™ shines a light on the vulnerabilities your peers ignore.

Others assume they're ready. You’re choosing certainty.

75%

of business owners have

no formal succession plan

30%

of small businesses successfully sell;

the remaining 70% often close or collapse

From there, you’ll be invited (if qualified) to

Pricing at a Glance

(transparent, simple)

Business Tax Savings Radar™: $0

Pre-Flight Tax Plan™: $15,000

(or $7,500 with Freedom Consultant Code)

Pilot Orientation™: $46,200

(or $15,000 with Freedom Consultant Code)

Wealth Map ATC™: Ongoing

Exit Flight Plan™: Custom Quote

FreedomExit.com — Sell the Business Deal Execution

Trusted by the Best

Who is this for?

We serve high-performing business owners who want to protect everything they’ve built

and exit on their terms.

If you’re paying $50K+ in taxes annually

or

Generating $2M–$50M+ in revenue, this is built for you.

The Builder Nearing an Exit

You're 1–5 years from a potential exit and want to ensure every dollar of your life's work converts into generational wealth.

$5M–$50M+ in annual revenue

Tired of vague answers and last-minute scrambling

Wants a clear, documented plan with backup strategies

We align your tax, insurance, and exit path into one clear flight plan.

The Over-Taxed Operator

You’re paying six figures in taxes every year and suspect you’re giving away more than necessary.

$2M+ in revenue or $75K+ paid in taxes last year'

CPA is reactive, not proactive

You want legal, vetted strategies to preserve wealth, not fund inefficiency

We create a shield that matches your ambition.

The Legacy Protector

You care deeply about your family, your team, and your impact—but haven’t coordinated all the moving parts.

Strong operating company, but minimal estate or continuity structure

Worried about what happens if something happens to you

Needs insurance, tax, and business transition strategies to work together

Our portal gives you one view of everything that matters.

The “Not Yet, But One Day” Owner

You're not ready to sell, but you're smart enough to prepare while you still have leverage.

in revenue

Exit is 5+ years away, but you're starting to ask the right questions

Wants to increase business value, protect cash flow, and avoid costly mistakes

We help you build your value and protect your trajectory—starting now.

Whether you're launching your exit or just opening your eyes

Pilot Orientation™ delivers a mission-ready plan, coordinated by seasoned advisors.

Mission-Aligned Partners

What Our Clients Say

Starr Turfgrass

“Partnering with Pilot Your Wealth powered by Freedom Consultants has been a game-changer for our business and our family’s future. Their Pre-Flight Wealth Check™ uncovered hidden tax savings we never knew existed, and their Risk-Mitigation Blueprint™ slotted seamlessly into our growth plans. We now have bulletproof insurance coverage, a clear continuity plan, and total financial clarity—so I can focus on turf quality, not spreadsheets.”

—

Nathan Starr, CEO, Starr Turf & Stone

Modern West Builders

“Pilot Your Wealth gave us our first real runway for exit planning—and we’ve only just taken off. In one strategy session, we identified $150K in potential tax savings and closed critical liability gaps in our policies. The real-time dashboard keeps us on course, and the ongoing support from the Freedom Consultants team feels like having an air-traffic controller for our finances. If you’re serious about protecting what you’ve built, this is your flight plan.”

—

Dave Grover, President, Modern West Builders

Frequently Asked

Questions

Is this a free consultation call?

The Business Tax Savings Radar™ is free. If you qualify, you may be invited to book a paid Pilot Orientation™ session, which is a deep-dive into your past tax-returns and insurance policies to give your the best-of-the-best in tax strategies.

What if I already have a CPA/Advisor?

We don’t replace, we coordinate. Your current advisors are puzzle pieces. We build the box.

Q: How secure is my personal information when I share my tax returns?

A: We take the confidentiality and integrity of your data very seriously. Our systems are audited under SOC 2 Type II standards and fully HIPAA‑compliant, which means:

Encryption at rest and in transit: All sensitive data is encrypted using industry‑leading protocols, both when stored on our servers and as it travels across networks.

Strict access controls: Only authorized personnel with a legitimate business need can view your information. All access is logged and regularly reviewed.

Journey Recap

Free

→ Diagnostic + Score

$20,200

→ Strategy session + 45 days of ATC™ Wealth Map

→ Deliver real transformation

$100/mo

→ Coordinated tax, insurance, exit

→ Long-term trusted advisory relationship

Large Call to Action Headline

© 2026 Pilot Your Wealth™ - All Rights Reserved.